No They Are Not. Don’t Fall Behind on your Tax Reports! Many expatriates operate under the misconception that because they are not living within US boundaries, they are not required to pay US income taxes. If only escaping from taxation were so easy. Expatriates will typically pay the normal taxes required by their host country and assume, incorrectly, that US taxes no longer apply to them. … [Read more...]

US Tax Filing Requirement

All US citizens, tax residents and green card holders are required to file tax returns and pay their taxes to the United States of America. If you belong to any of these categories, regardless of your place of residence and where you receive your income, then you are covered by this US IRS directive. You are a tax resident if you measure up to the test on substantial presence for every … [Read more...]

A Warning to All Americans Living Abroad

There has been a new law enacted by the IRS that is putting a heavy burden on American’s living abroad. If you are an American living abroad, whether you are a citizen or a green card holder, you are to file your tax form on April 15, 2012. This new IRS ruling results from a FATCA law that also require you to use Form 8938, where you will list down all your foreign stocks, … [Read more...]

Form 8865 – IRS Form for Foreign Partnership Ownership

If you are a US tax payer who owns 10% or more of a foreign flow through a Limited Liability Company (LLC) or a foreign partnership, you should file Form 8865 together with your Individual Income Tax Returns. Form 8865 will indicate the annual Balance Sheet and the Income and Expense Statements of the foreign partnership. This report will also show the details of the partnership including your … [Read more...]

Foreign Pension Plan Contributions – When are they Taxable under US Tax Laws

If you are a US Expatriate employed by a foreign employe you are allowed to make contributions to a foreign pension plan. These foreign pension plans usually have advantageous tax treatment under local tax laws. Regrettably, these foreign pension plans normally don’t meet the “qualification rules” of America. Consequently, the advantageous treatment under local laws are not made available to … [Read more...]

Report of Foreign Bank and Financial Accounts

You need to file this report with the US Department of Treasury if you meet certain conditions. These include: having a financial interest in, having authority to sign for or any other kind of authority over financial account(s) in foreign countries. Your account must also be valued at over $10,000. If you meet any of these conditions you need to file this report. Our professional … [Read more...]

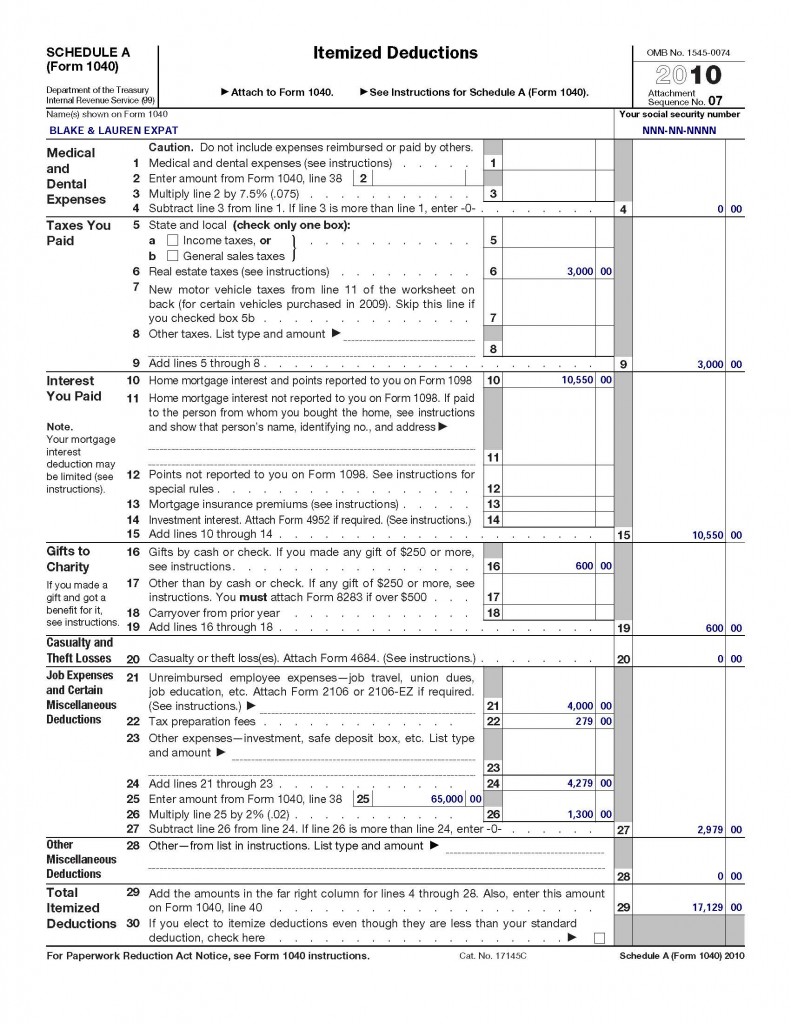

Using Itemized Deductions on United States Expatriate Taxes

Using Standard or Itemized Deductions To file expatriate taxes in the United States, you will use the standard deduction or itemized deductions as a way to decrease the amount of your income that is taxable. Each year, the IRS adjusts the amount of the standard deduction for each filing status. If you believe that your itemized deductions are greater than the standard deduction amount, you should … [Read more...]

United States Expatriate Taxes – Form 1116 (Foreign Tax Credit)

Most foreign countries collect taxes from foreign residents just the same as they do with national residents. The Foreign Tax Credit allows United States residents and citizens living abroad to claim any taxes paid to a foreign country on their United States expat taxes. This credit is claimed on Form 1116 and it needs to be submitted along with the usual tax return, Form 1040. The Foreign Tax … [Read more...]